‘The new duty will drive a change in culture at firms. We expect firms to step up and put consumers at the heart of what they do. . .The duty will also help create an environment for healthy competition between firms, encouraging them to be innovative in developing products and services that meet consumers’ needs.’

Sheldon Mills, Executive Director of Consumers and Competition at the FCA

When the FCA released its new consumer duty in July 2022, it fully intended to shake up the financial industry’s relationship with its customers. As suggested above, the duty will hold firms accountable for developing products that serve the needs of consumers first and foremost, but it is also an opportunity to make products and services much more usable for customers.

One of the specific new requirements is that products, services and communications are tested with consumers. In addition, the duty requires that in this testing, particular attention is paid to vulnerable consumers who might have different needs from other users. Carrying out testing such as this, including recruitment of participants, selection of research methods and analysis of results, is what user researchers do every single day.

Placing the users ‘at the heart’ of the development process is precisely what we set out to do. We are different from market researchers in that we do not seek to find out what appeals or what would be an attractive option for a user. Instead we focus more on what works for users: what helps them understand a product, what features allow them interact with it efficiently, what design changes can impact the effectiveness of these interactions.

User researchers can make a strong contribution to the work required by the FCA’s new consumer duty regulations. Some ideas about how we might do this are below.

Participants

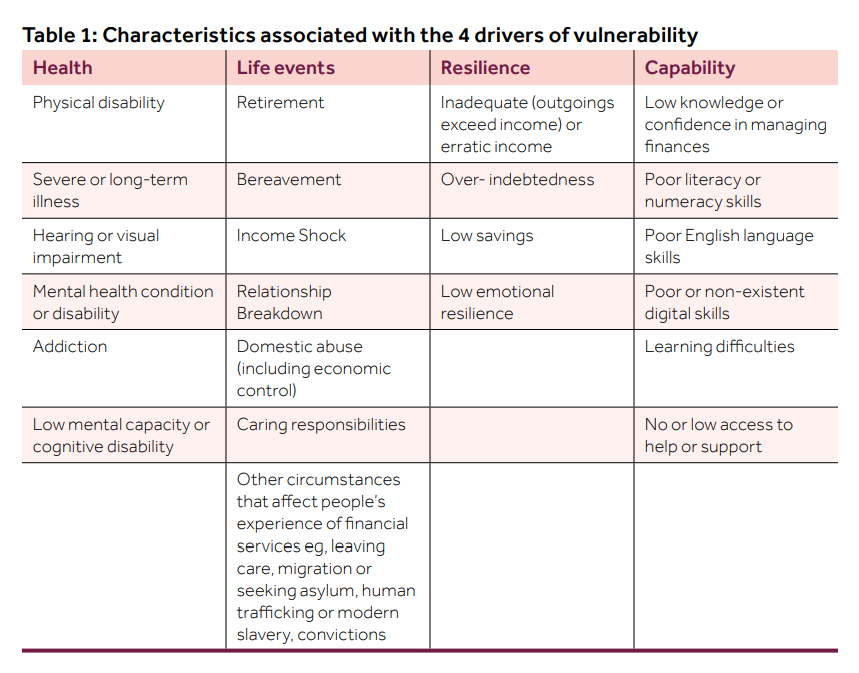

The new consumer duty has brought in a particular focus on designing for the needs of vulnerable customers. These customers are defined in the FCA’s guidance on treating vulnerable customers fairly as those who may have pressures on their health, low financial and/or emotional resilience, low capability with maths and English or who have experienced an influential life event.

Recruiting and testing with participants who fall into these categories is something we regularly do in user research. In fact, there is a school of thought within user experience that designing for extremes is a way of developing the best possible experience for everyone. In practice, this could mean testing with vulnerable participants first under the assumption that if their needs are met then the design is likely to work for other users. After iterating the design, it could then be tested with other users.

However, recruiting vulnerable participants does require some lead time, and we recognise that some projects are more urgent than others. Also, some elements of a product that need to be tested may have had a large degree of success already. In these cases, unmoderated testing with larger numbers offers the opportunity to test with vulnerable and non-vulnerable participants simultaneously. Vulnerabilities that appear in the cohort through natural fallout can be tracked to determine if more research needs to be conducted with specific vulnerable groups.

Methods

The FCA consumer duty rules now require that firms track areas of their products, services and communications where problems have been seen to arise. These should then be tested with consumers. In these cases, moderated usability testing is often the most efficient way of establishing the causes of the problems and gathering appropriate evidence for recommending changes.

In moderated usability testing sessions, a researcher leads a participant through a series of tasks that require them to interact with a product, prototype, website or communication. This allows us to establish the pain points users are experiencing, the mental models that may facilitate or hinder their engagement with a product and whether or not they understand a product or a piece of content. These sessions can be conducted with non-vulnerable participants, but they are particularly well-suited for vulnerable participants, especially when the topic is a sensitive communication or a product that carries a high degree of risk.

Sometimes larger numbers of participants are needed in order to establish confidence amongst stakeholders or there might be a large degree of confidence about a product or communication already. In these cases, unmoderated testing can be ideal. These tests can recruit large numbers quickly and they can collect both quantitative and qualitative data. Participants can be asked to do click tests, think alouds, survey questions and more. We can track whether participants are experiencing any vulnerabilities outlined by the FCA, and we can carry out separate testing with these participants if needed.

Once testing has been carried out, it may become clear that a product simply isn’t working as it should for its target market. The consumer duty regulations do in fact require that products be changed to better suit the needs of customers, if that is shown to be needed in testing. When this happens, one method we recommend would be depth interviews. In these sessions, we take a step back from looking at specific elements of a product and try to deeply understand the participant’s mindset. We aim to understand the how and why of a product’s weaknesses in order to recommend reliable improvements.

Sometimes it may be necessary to rethink how a product is delivered on a larger scale, where each of the customer’s interactions with a product are mapped and analysed.

In these cases, we would recommend a series of activities that fall under the heading of service design. This would include research with users, stakeholders and potentially those who provide the service as well as mapping of customer touchpoints and behind the scenes processes.

What next?

Some testing under the new FCA consumer duty rules will inspire improvements to websites or apps or communications that are generally working well as they are. In these cases, a system of monitoring the performance of these assets can flag up any problems that arise or firms might establish a regular cadence of testing and improvements.

In other cases, larger changes will need to be made, which will require additional research and design work. User research can in fact completely reshape a firm’s understanding of its users. The new consumer duty’s emphasis on fair, responsible treatment of customers is likely to foster a new era of innovation and diversification of financial products.

So the silver lining to these new regulations is that we can begin to creatively imagine how customers can be served in new ways. How can we help them better engage with complex information about mortgages or insurance or investments, for example? How can we best handle sensitive topics like bereavement or scams? What would a current account or an ISA or an insurance product designed specifically for a vulnerable user look like?

Need help?

The level of work and the details required to meet FCA requirements can be daunting. If you’re just starting on your compliance journey, we can partner with you to develop a testing strategy and roadmap. If you have a backlog of communications to review, we can support you with testing and see how you stack up against the FCA’s required duty of care. Get in touch, we’d love to talk.